Blog

Blog

By Lucratus CFO Services Pvt Ltd

April 09, 2025

Virtual CFO Services for U.S. SaaS Companies

Virtual CFO Services for U.S. SaaS Companies: What You Must Know

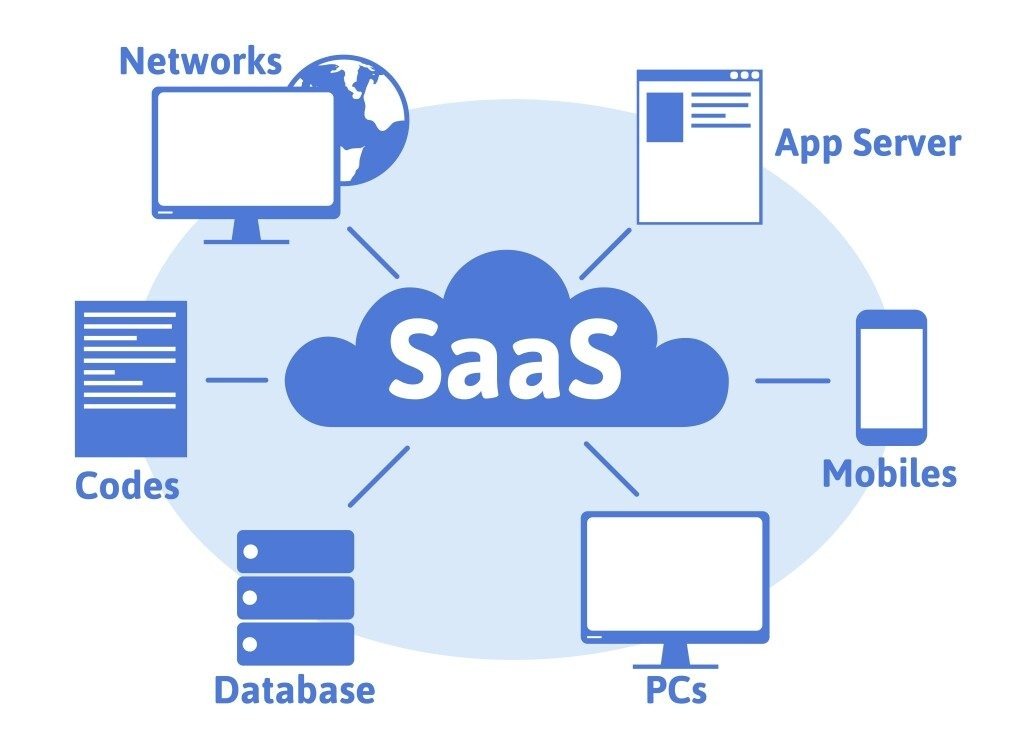

As U.S.-based SaaS (Software-as-a-Service) companies navigate rapid growth, complex compliance requirements, and fierce market competition, financial leadership becomes essential. Enter the Virtual CFO (vCFO) — a strategic partner that offers expert financial oversight without the full-time cost of an in-house CFO. Here's what you need to know about leveraging virtual CFO services to drive growth, maximize valuation, and streamline operations in your SaaS business.

What Is a Virtual CFO?

A Virtual CFO is a financial expert who provides CFO-level services on a part-time, remote, or contract basis. These professionals bring strategic financial guidance, performance tracking, cash flow management, and investor readiness support — often tailored specifically to the unique challenges faced by SaaS companies.

Why SaaS Companies Need a Virtual CFO

SaaS businesses have distinct financial models, primarily built around recurring revenue, subscription pricing, and high customer acquisition costs (CAC). This makes financial forecasting and metric tracking more complex — and more critical — than in many other industries. Here’s how a vCFO adds value:

1. Improved Financial Visibility

A vCFO builds and maintains dashboards to track key SaaS metrics like:

Monthly Recurring Revenue (MRR)

Customer Lifetime Value (CLTV)

CAC

Gross Margin

Net Revenue Retention (NRR)

Accurate tracking of these metrics helps founders and investors make informed decisions.

2. Cash Flow Management

SaaS businesses often face cash flow crunches due to delayed profitability. A virtual CFO can optimize cash flow forecasts, prioritize spending, and even help in securing lines of credit or venture debt.

3. Fundraising & Investor Relations

Preparing for Series A, B, or beyond? A vCFO helps package your financials, build compelling pitch decks, and conduct due diligence support — increasing your chances of securing funding.

4. Scalable Financial Systems

Virtual CFOs help set up accounting, billing, and ERP systems that scale with growth. They also assist with choosing the right finance tech stack, integrating automation, and ensuring SaaS-specific revenue recognition compliance (ASC 606).

5. Strategic Advisory

From pricing strategies to M&A planning, a vCFO offers forward-looking advice that helps align financial goals with long-term strategy.

Key Services Offered by Virtual CFOs for SaaS

Financial Planning & Analysis (FP&A)

Revenue Forecasting & Budgeting

SaaS KPI Reporting

Board & Investor Reporting

Burn Rate and Runway Analysis

Cost Optimization

Fundraising Strategy & Support

Audit & Tax Preparation

When to Hire a Virtual CFO

You might consider hiring a vCFO if:

You're preparing for a funding round

Revenue is scaling and financial operations are becoming complex

You need to improve cash flow management

You want expert financial guidance without hiring a full-time CFO

Choosing the Right Virtual CFO Partner

When selecting a vCFO, look for:

-

SaaS Industry Expertise – Knowledge of recurring revenue models and SaaS metrics is non-negotiable.

-

Tech Savvy – Familiarity with tools like QuickBooks, NetSuite, Stripe, SaaSOptics, and ChartMogul.

-

Scalability – Can they grow with you as you expand?

-

Proven Track Record – Ask for case studies or references.

The Cost of a Virtual CFO

vCFO services typically cost between $3,000 and $15,000+ per month, depending on the scope, experience, and company size. Compared to a full-time CFO (often $200K+ annually), this model is far more affordable for early to mid-stage SaaS companies.

Final Thoughts

Virtual CFO services can be a game-changer for SaaS businesses looking to scale smartly. With deep financial insight, operational experience, and strategic foresight, a virtual CFO equips your company to make data-driven decisions, attract investors, and build sustainable growth.

Whether you’re bootstrapped or VC-backed, the right financial partner can mean the difference between scaling with confidence and running out of runway.

Get our latest News & stay informed.