Blog

Blog

By Lucratus CFO Services Pvt Ltd

April 04, 2025

How Virtual CFO Help US Startups

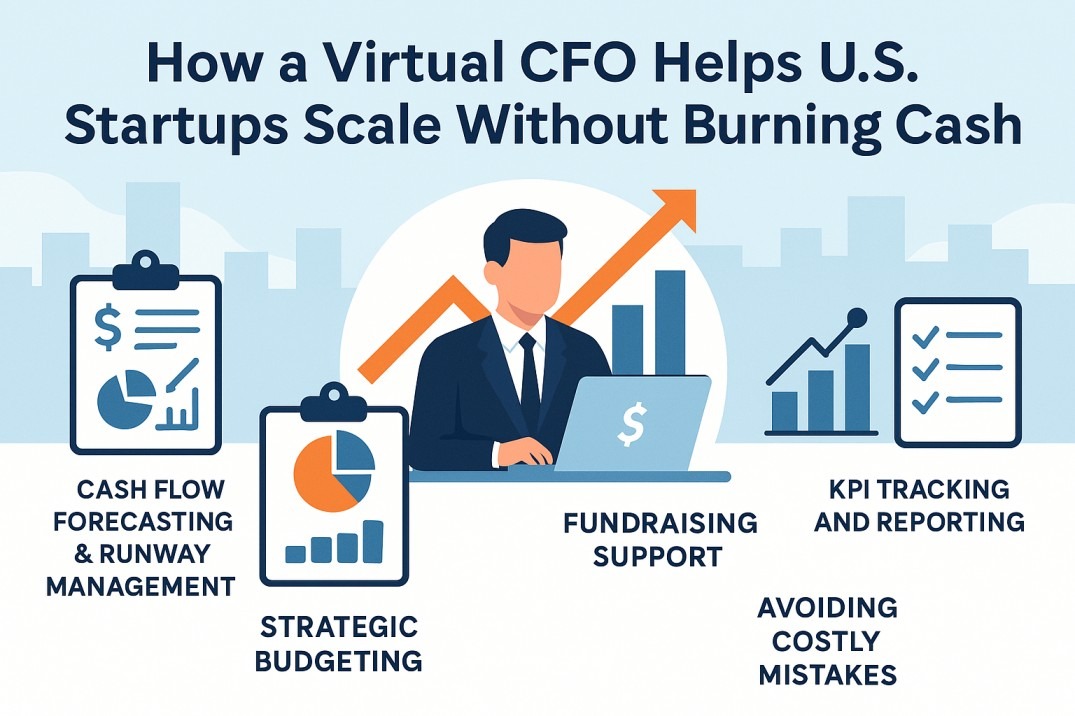

How a Virtual CFO Helps U.S. Startups - Scale Without Burning Cash

In the high-stakes world of startups, scaling fast can be the difference between becoming the next unicorn—or becoming another failed statistic. But growing quickly comes with a big catch: managing cash flow while navigating uncertainty. That’s where a Virtual CFO (Chief Financial Officer) becomes a game-changer.

For many U.S. startups, hiring a full-time CFO is too expensive early on. Enter the Virtual CFO, a cost-effective financial strategist who brings executive-level expertise—without the hefty salary. Here’s how startups can scale smarter, not just faster, with the help of a virtual CFO.

What is a Virtual CFO?

A Virtual CFO is an outsourced finance professional who provides the strategic financial guidance of a traditional CFO, but on a part-time, remote, or contract basis. They handle forecasting, budgeting, financial reporting, fundraising strategy, and more.

Unlike a traditional bookkeeper or accountant, a virtual CFO plays a strategic role, helping founders make data-driven decisions to grow sustainably.

The Startup Problem: Scaling vs. Cash Burn

Startups often face a tricky dilemma:

- Spend aggressively to capture market share

- Preserve runway to avoid running out of cash

Without experienced financial leadership, founders often overspend on growth (marketing, hiring, product development), without clear visibility into whether that spend is delivering ROI.

That’s where things spiral—burning cash without a clear path to profitability or the next funding round.

How a Virtual CFO Helps Startups Scale Smart

1. Cash Flow Forecasting & Runway Management

A virtual CFO builds financial models that map out your cash inflows and outflows. This means founders always know:

- How many months of runway are left

- What burn rate is sustainable

- When (and how much) additional funding will be needed

2. Strategic Budgeting

Scaling isn’t about cutting costs—it’s about spending smarter. A virtual CFO helps allocate resources based on ROI, ensuring that each dollar spent moves the needle.

They answer questions like:

- Should we hire now or outsource?

- Is this ad spend generating positive LTV/CAC ratios?

- Can we afford to expand into a new market?

3. Fundraising Support

Raising capital is time-consuming and complex. A virtual CFO:

- Prepares financials for investors

- Builds pitch decks with real, defensible data

- Crafts compelling financial narratives

- Helps negotiate term sheets

- This makes the startup more investor-ready and increases the chances of closing rounds faster.

4. KPI Tracking and Reporting

Virtual CFOs set up dashboards to monitor key performance indicators like:

- Monthly Recurring Revenue (MRR)

- Gross Margin

- Customer Acquisition Cost (CAC)

- Churn Rate

- Burn Multiple

With consistent reporting, founders can make quick course corrections before issues become crises.

5. Avoiding Costly Mistakes

From compliance risks to tax oversights to mispriced products—startups can bleed money through seemingly small missteps. A virtual CFO ensures:

- Clean books

- Scalable systems

- Audit readiness

- Smart pricing models

The ROI of Hiring a Virtual CFO

For a fraction of the cost of a full-time CFO (typically $5k–$10k/month vs. $250k+/year), startups get:

✅ Strategic guidance

✅ Accurate financials

✅ Fundraising support

✅ Risk mitigation

✅ Peace of mind

This is especially crucial during key growth phases—Series A preparation, product launches, or international expansion.

Final Thoughts

Scaling a startup without financial leadership is like flying a plane without instruments. You might take off, but staying airborne—and reaching your destination—is another story.

A Virtual CFO equips U.S. startups with the tools, insights, and strategy needed to grow fast without burning out financially. For founders who want to build sustainable, investable companies, this isn't just a nice-to-have—it’s a necessity.

Get our latest News & stay informed.